4 simple and practical benefits of owning commercial property in a SIPP

If you are a regular reader of our updates, you will know that we often talk about commercial property purchase within SIPPs.

As well as being an area of strength for IPM, it is also a subject that is popular among our advisers. Indeed, property related content is among the most viewed on our website.

Often, we look at specific scenarios around purchasing property in a SIPP or some of the quirky enquiries advisers and clients ask us to consider, including:

- How to make a transfer in-specie from another SIPP/SSAS

- The weird and wonderful types of property that can be held in a SIPP

- When a SIPP property purchase may not be the right option for your client

- How SIPP property purchase can help the cashflow of your client’s business

However, many people ask us a simpler question: what are the benefits of holding a commercial property within a SIPP?

IPM own more than 1,100 properties on behalf of our clients, with around 40 transactions taking place at any one time. While the number of transactions we undertake varies annually, enquiry levels continue to increase year-on-year.

Some advisers are well versed in SIPP property purchase. We also often hear from advisers for who this is a new experience – one that they may recall theoretically from various exams but have never actually put into practice!

You can read about the “how” of SIPP property purchase including the practicalities, who is involved, and how transactions actually take place on our website.

Here, you can find out more about why your clients might want to own commercial property in a SIPP.

A lot of these reasons consider the general benefits of pensions. However, when coupled with a commercial property investment, these can make compelling arguments for considering this approach.

1. Asset growth

When looking at an investment for a pension, long-term asset growth is a key consideration. After all, pensions primarily exist to provide individuals with retirement benefits, so the investment timescale is likely to be considered by decades.

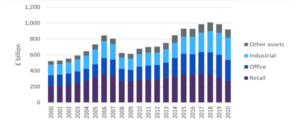

According to research by the Royal Institution of Chartered Surveyors (RICS) the capital value of the UK commercial real estate stock has nearly doubled since 2000, peaking in 2018 at just over £1 trillion. This is mostly thanks to the growth in value of office, industrial and other assets.

Source: RICS

While you could argue that other investment strategies can also return similar or greater growth over the same period, commercial property can provide less volatile growth than other asset classes.

A potential downside of holding commercial property is lack of diversification and liquidity. Often a property will make up a significant portion of a client’s SIPP value.

If the plan is to sell the property in the future to generate liquidity for a pension commencement lump sum (PCLS) and this happens to coincide with a downturn in property prices, this will affect the benefits the client will be able to receive.

2. Investment yield

As well as asset growth, investment yield is often another key consideration for pension investment. This is especially the case where an individual is taking regular income under flexi-access drawdown, as the SIPP uses this yield to pay this income.

It is not unusual for us to see commercial properties generating a yield of anywhere between 6% and 10% a year. These can be linked to a lease for three or five years, giving the SIPP a level of security in respect of its return on investment.

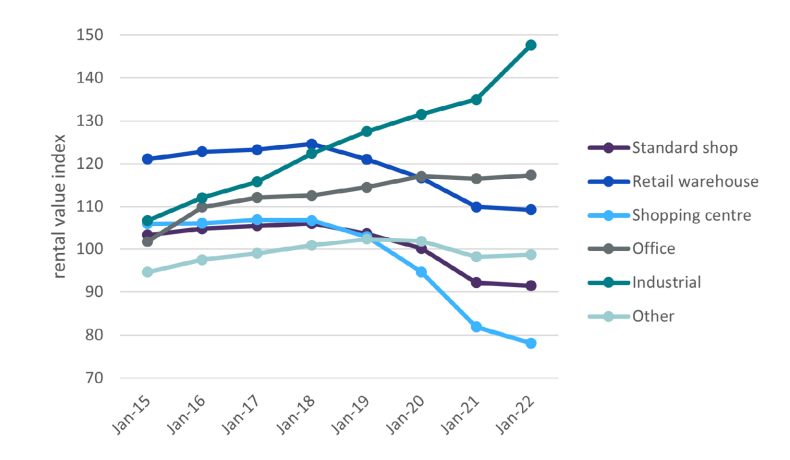

As you can see from the graph below, the types of commercial property your clients are likely to be buying – industrial and office units – saw the investment yield rise between 2015 and 2022.

Source: RICS

Where the rent a client receives is not being used to pay out income to the SIPP beneficiary, this can then be reinvested in the SIPP on a regular basis by the adviser using a platform or other investment strategy of their choice.

At IPM, we do not charge additional fees for holding investment solutions alongside commercial property, or for regular investments. So, you can implement this strategy without the concern of this generating additional costs to the client.

3. Tax benefits

The tax benefits of pensions are well known. However, when you start to consider them in relation to purchasing commercial property within a SIPP, this is where property investment in a pension dovetail well.

When you sell an asset within a SIPP, there is usually no Capital Gains Tax (CGT) to pay.

If a client buys a property and holds it for many years, the capital gain when the property is sold (and thus the CGT liability) could be significant. This would not apply within a SIPP.

Additionally, any investment yield received by the SIPP is not subject to Income Tax. Where a property investment in a SIPP is concerned, the rent received by the SIPP is tax-free.

For a double tax benefit, if an individual’s company is the tenant of the property owned by the SIPP, then they will need to pay rent to the SIPP to occupy the property. Rent is usually classed as a business expense, that is Corporation Tax deductible, and goes into the SIPP for the individual’s benefit Income Tax-free. It’s a win-win!

Example

The Corporation Tax rates changed in April 2023 to 19% for companies with profits below £50,000 (the “small profit rate”) and 25% for those companies with profits over £250,000 (the “main rate”). There is a marginal rate between 19% and 25% for companies with profits between these two amounts.

Richard uses his SIPP to buy the commercial property that his business operates out of from himself.

His company currently has taxable profits of £65,000, and the company is required to pay the market rate of rent (£20,000 a year) to the SIPP for use of the building.

Assuming profits of £65,000, this would leave Richard’s company with a Corporation Tax bill of £13,475.

However, as the company must pay rent to the SIPP, these profits reduce to £45,000. This means that Richard’s company pays Corporation Tax at the small profit rate, bringing the tax bill down to £8,550.

Another tax benefit occurs when a property is VAT-elected. In this scenario the purchase price is usually subject to an additional 20% in VAT. By opting the SIPP to tax, the SIPP can reclaim the 20% VAT on the purchase price. Given the values of property, this 20% can be significant.

4. Passing assets to beneficiaries

The death benefit rules for defined contribution schemes such as SIPPs are as generous as they have been for a long time.

At present, if individual were to die before the age of 75, any distributions for the SIPP to the nominated beneficiaries are tax-free. There is now not even a Lifetime Allowance charge to contend with!

If that individual were to die over the age of 75, distributions can still be made from the SIPP to the beneficiaries. These are taxed at the beneficiary’s marginal tax rate.

The beneficiary also has the added flexibility that allows them to retain any benefits that have been nominated to them in the tax-efficient environment of a SIPP.

This means that careful planning should go into taking benefits out of a tax-exempt environment to an individual’s estate, as these could be subject to Inheritance Tax (IHT) and Income Tax if the SIPP holder died after the age of 75.

As you have read, a commercial property will usually make up a significant portion of an individual’s assets in the event of their death which, depending on how they hold the property, could considerably increase the IHT that is due.

Where a client holds the property within a SIPP, they do so in trust outside of their estate for IHT purposes. An individual can nominate any beneficiary they wish to receive the benefits, and thus the property, from their SIPP.

Furthermore, those beneficiaries are not only able to retain the property within the SIPP should they wish. They can also nominate their own beneficiaries who will further benefit from the property tax-efficiently in the event of their death.

Get in touch

If you want to have a chat about the potential of SIPPs for your clients, particularly regarding holding commercial property, please contact us. Email info@ipm-pensions.co.uk or call 01438 747151.