Your complete guide to commercial property purchase in a SIPP

Commercial property purchase within a SIPP is a popular investment choice of IPM clients. This is evidenced by the year-on-year increase in enquiries we receive on the subject.

You recently read about the benefits of holding a commercial property within the SIPP. You have also read about:

- How a SIPP property purchase can assist a client’s business

- How the death benefit rules for SIPPs can be used to tax efficiently pass a large asset such as a commercial property between generations

- The types of properties that can be held within a SIPP

For many advisers who contact us, commercial property purchase within a SIPP is not something they undertake regularly on behalf of their clients.

In some instances, advisers are reluctant to carry out this work as it is perceived to be complex. In the past, they may have been involved in messy SIPP property transaction, or a colleague who once worked at a different company where someone bought a property through a SIPP told them that it was a nightmare!

There is no denying that a SIPP property purchase will be a more complicated process than some of the day-to-day work many advisers carry out.

However, when working with the right SIPP provider (hint, hint – check out why you should consider IPM for SIPP property purchase) and with the correct preparations in place before the advice is given, there is no reason why buying a property within a SIPP should be more difficult than any other property purchase transaction.

Read on for some of the key considerations before starting out on a SIPP property purchase, the areas you need to consider, and how the process works.

Rule number 1 – the SIPP owns the property, not the client

As you read in this article, there are many advantages to holding a commercial property in a SIPP. However, in exchange for all these tax advantages, HMRC have guidelines that must be followed.

Notice these are “guidelines”, not “rules”. Guidelines are open to interpretation, which is why, when you ask two SIPP providers the same question, you may get two different answers. The answer will be determined by the provider’s approach and tolerance to risk, as they will be the legal owners of the property, as trustee to the client’s SIPP.

This is where rule number 1 comes in: the SIPP provider owns the property, not the client.

This should be one of the first things an adviser should mention to a client when beginning this discussion. This can be particularly relevant where the property concerned is being occupied by the client’s company.

At IPM, we will always look to be as accommodating and flexible to client requests as possible. However, our first duty of care is to the SIPP, and we will not do anything that will either give rise to a tax charge, or lead to something that is difficult to administer, either now or in the future. This may not always mirror what the client wants to do outside the SIPP.

Explaining that it is the SIPP provider that owns the property would be the first thing we’d suggest any adviser mentions to clients when they wish to proceed with a SIPP property purchase. Then, you should establish whether this causes any issues with any personal plans that they have with your chosen provider.

One SIPP or several?

We consider our SIPP as a blank sheet of paper, allowing advisers to build bespoke SIPPs for their clients tailored to their specific requirements. While some clients may require a platform, DFM, or cash solution within their SIPP, others will want to purchase a commercial property.

Where we are purchasing a property on behalf of one client, the SIPP structure is fairly straightforward. We purchase the property using monies held within the trustee bank account and this is then held for the benefit of that client.

If there are residual monies in the SIPP after the purchase, or the adviser wishes to invest the rental income, an investment solution can be added into the SIPP at no additional charge from IPM.

Group SIPP property purchase is also a popular option among our clients. We see many scenarios where clients consider this option:

- Where co-owners of a company may want to purchase a property for their business to operate from

- Spouses combining their SIPP monies. This could be where both have the same investment ideas or where a spouse’s pension benefit could help with funding of a purchase

- Family members (spouses, siblings, parents and children or grandchildren) coming together to combine monies. Again, this could be to assist with a funding problem or where there is a family business, and the SIPP owns the property from which the business operates.

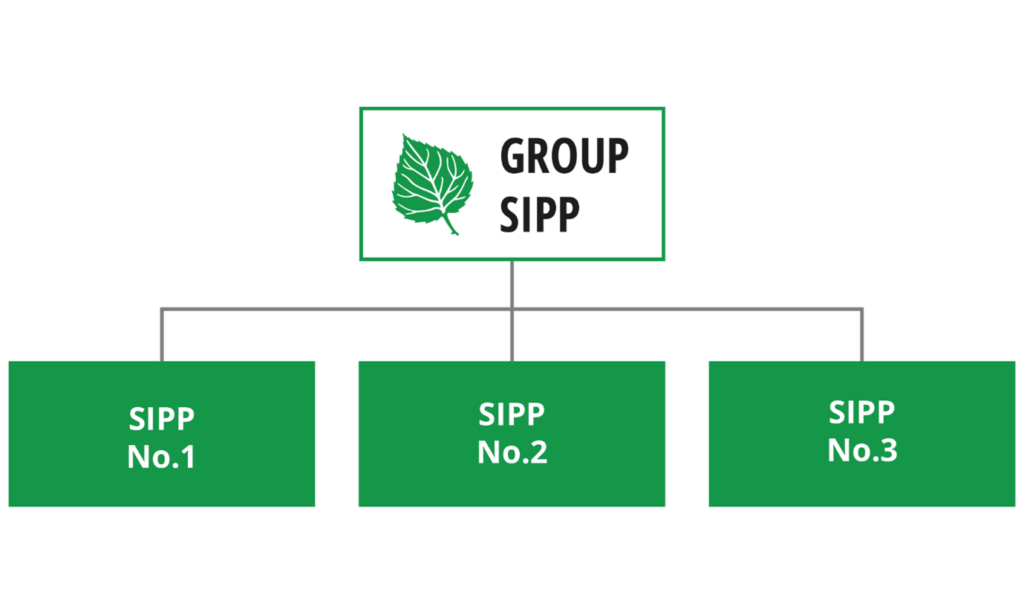

Where more than one SIPP has an interest in a property, IPM will establish an individual SIPP for each client concerned and consolidate monies in the usual way.

If these clients are then to combine their monies for a property purchase, we create a group arrangement that sits above these individual SIPPs. We move money from the individual SIPPs to the group SIPP to facilitate the purchase. In turn, each individual SIPP then owns a percentage of the group SIPP proportionate to the amount it put into the group SIPP.

By structuring the SIPP and purchase in this way, each beneficiary still has an interest in the property through the group SIPP arrangement.

However, the remainder of the SIPP can be tailored to the individual’s requirements without necessarily involving the other group members. As an example:

- One individual may want to make further contributions.

- One individual may wish to make additional investments in their SIPP separate to other group members.

- One individual may wish to take a lump sum of income from their share of the rent that is passed back from the group SIPP to the individual trustee bank account.

Borrowing and VAT

Two things that have a big impact on any purchase are:

- Whether borrowing is required

- Whether the property is VAT-registered.

A SIPP can borrow up to 50% of its net scheme assets under HMRC guidelines. So, if the SIPP value is £300,000, borrowing of up to £150,000 can be drawn down to give a purchasing ability of £450,000.

While lenders may be concerned with loan to values, for SIPP purchases this is not as much of a concern as the 50% rule.

At IPM, we do not operate a panel of banks that must be used to obtain a mortgage. The terms of the loan should be negotiated directly with the chosen lender and the details passed to IPM, so we make the necessary arrangements during the purchase process.

We recently spoke to a specialist mortgage lender for the SIPP market to get their views on the lending market.

Consideration also needs to be given if a property is VAT-registered. Note that if a business occupying a property is VAT-registered, this does not necessarily mean that the building will be too.

Where a property is VAT-registered, 20% will need to be added to the purchase price and this will have an impact on the cashflow of a SIPP purchase. Even though the SIPP is often able to reclaim any VAT on the purchase price, the money must be in the SIPP in the first place to complete the transaction. Where borrowing is required, the VAT must be included in the 50% borrowing limit.

To reclaim the VAT, IPM must register the SIPP with the VAT office. This process takes place as soon as we can proceed with instructions as, since 2020, there have been significant delays in the VAT office processing registration requests. At time of writing, these are usually taking five months.

Going forward, IPM as the trustee will collect VAT on any rent paid to the SIPP and pay this to the VAT office on a quarterly basis when we complete the VAT return.

Part purchase of property by the SIPP

It is a little-known fact that, rather than purchasing an entire property, there is nothing preventing a SIPP owning part of a property.

This will come down to the appetite and attitude to risk of the provider in question. At IPM, we are happy to consider part purchases on the following basis:

- The third party that the SIPP owns the property with is connected with the SIPP beneficiary. This is to aid with ease of administration of the property in the future.

- The property is not VAT-registered. We have no issues with buy a VAT-registered property using one SIPP or several. However, where a part purchase is taking place, we are unable to limit the SIPP’s liability with the VAT office. As such, should the third party the SIPP owns the property with not pay any VAT that is due, the VAT office could look to the SIPP or IPM to recover this and any associated fines.

The third parties involved in a commercial property purchase

With any property purchase there are a number of parties involved in getting transactions over the line. While a SIPP property purchase is no different, the third parties involved and how these interact with one another can vary with each provider’s approach.

Typically, these are the third parties that a SIPP provider will need to liaise with to complete on a purchase.

Solicitors

Just like any purchaser, the SIPP will need to appoint a solicitor to represent its interests during the transaction.

There are several intricacies of SIPP purchases that a solicitor needs to be aware of during the conveyancing process.

This is why IPM operates a panel of solicitors to act on our SIPP’s behalf. Each member of our panel is vastly experienced in SIPP transactions and have good relationships with IPM, which can be crucial when it comes to getting particularly tricky purchases through to completion.

We are happy for individuals to appoint their own, “off-panel” solicitor to act for the SIPP at no additional charge from IPM. However, to protect the SIPP’s interests, we will require a member of our panel to oversee the transaction.

Surveyors

One of HMRC’s requirements is that a specific type of valuation must be produced for any property acquired by a SIPP.

We do not have a panel of surveyors that must be selected for this, however we will require the chosen firm to be RICS accredited. Where borrowing is involved, it is not unusual for the bank to insist on their surveyor to provide the valuation for the purchase.

Property manager

A property manager must be appointed to deal with any day-to-day matters that may arise with the property.

Again, we do not have a panel of managers that a client must select from. A local firm can be appointed in this role or, if preferable, in some circumstances we are happy to for the SIPP beneficiary to be the property manager.

Banks

As you read above, we do not operate a panel of banks that a client must select from when lending is required. This allows the SIPP beneficiary to source the best deal and most favourable terms. IPM will then take over once the purchase is underway.

Get in touch

If you have any clients looking to purchase, or part purchase, a commercial property using a SIPP, we’re highly experienced in this type of transaction. To find out more, please get in touch. Email info@ipm-pensions.co.uk or call 01438 747151.