How your clients can benefit from the investment flexibility the IPM SIPP offers

It’s fair to say that 2022 has continued the turbulent theme of recent years for investors.

The impact of Kwasi Kwarteng’s mini-Budget in September saw a chain of events that led to the FTSE 100’s lowest point since the early days of the Covid-19 pandemic. In addition, the Bank of England (BoE) reacted by raising interest rates to their highest levels since the late 2000s.

This is all against a backdrop of a cost of living crisis that is affecting many people in the UK.

No doubt as advisers you have been working with clients over the last 12 months who have been concerned about the return on investments and the impact that inflation will have on any cash holdings they may have, despite the interest rates available being significantly higher than in recent years.

At IPM, we see the outcome of this work when it comes to changing investment strategies and the different attitudes people have when it comes to investing.

For example, with an increase in interest rates available for cash deposits, we have seen more requests for investment into SIPP deposit accounts and cash management solutions.

Commercial property continues to remain a popular option with IPM clients, with both asset values and yields for those properties with good tenants achieving favourable returns for clients.

You have previously read about the three different types of SIPP that are available in the market. In this, we considered the benefits of a bespoke SIPP which will allow a wide range of assets with different investment houses.

IPM is particularly well positioned in the bespoke SIPP area for SIPPs containing a range of investments. We do not have panels of investment houses you must select from, and we do not make additional charges for making or holding multiple investments in the SIPP (other than purchasing commercial property or investing in a non-standard asset).

With the increase in requests for multiple investments in our SIPP, we thought we would run you through some examples of what typical IPM SIPPs can look like.

Commercial property

Regular followers of our content will know that we frequently discuss holding commercial property within a SIPP.

It is a big part of our offering, and we own more than 1,100 properties on behalf of our clients. We employ a dedicated property team, a member from which is allocated to each transaction.

In many instances, the property will initially represent most of the SIPP’s value. However, over time rent is likely to accumulate in the trustee bank account as well as contributions being paid. So, it is not unusual for IPM to see the SIPP hold an alternative investment solution alongside the property.

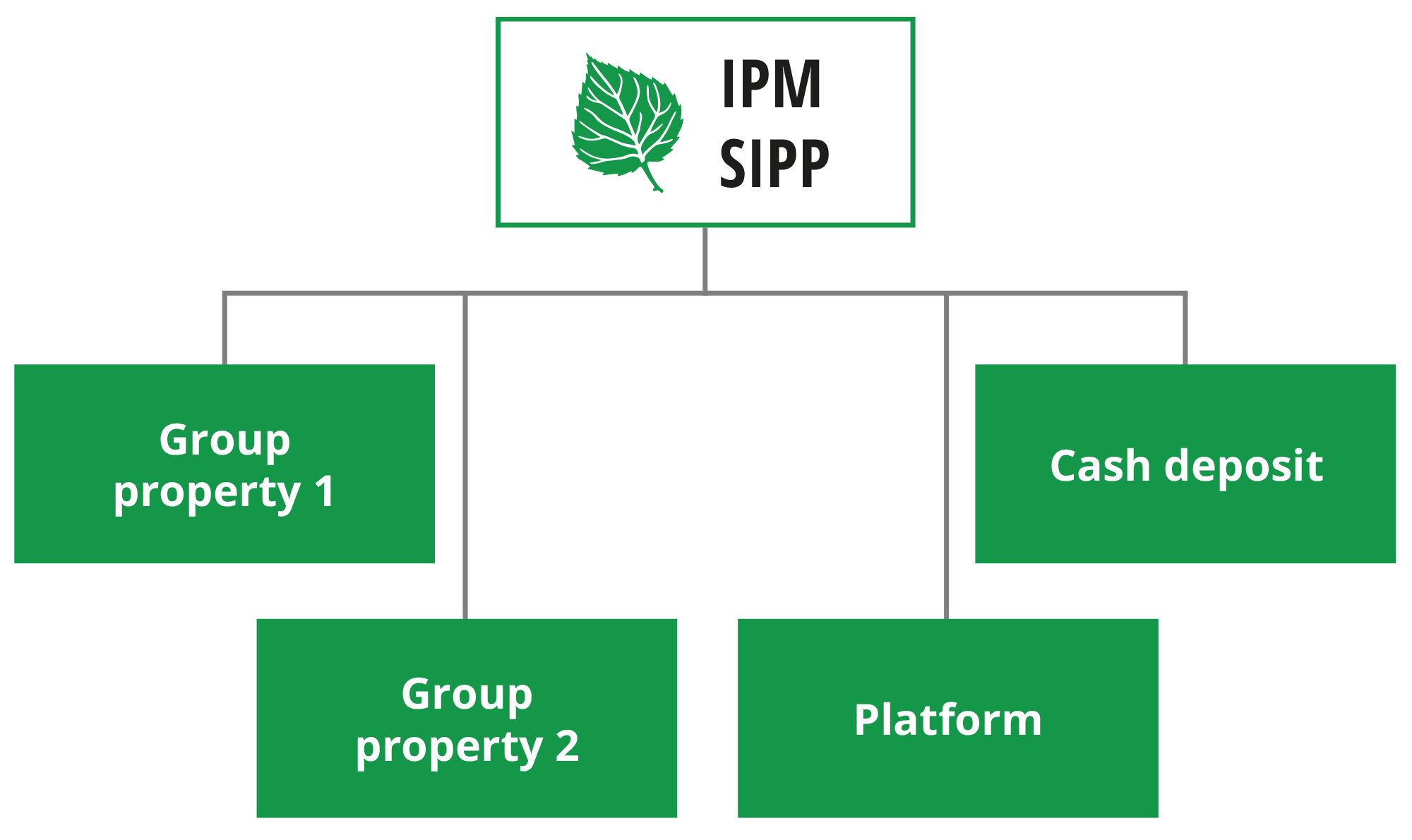

For larger SIPP values, the spread of SIPP investments may be greater, especially where a client holds an interest in commercial property through a group.

As well as being cost-effective for holding multiple investment in SIPPs, IPM also has one of the best value offerings in the market for holding commercial property.

While we make charges for purchasing a commercial property and other one-off events (such as when a new lease is required), unlike most SIPP providers we don’t charge an additional annual property fee.

This means that once a property is acquired, this can be held inside the SIPP alongside other investments at no additional charge.

Larger SIPP values, more investment houses

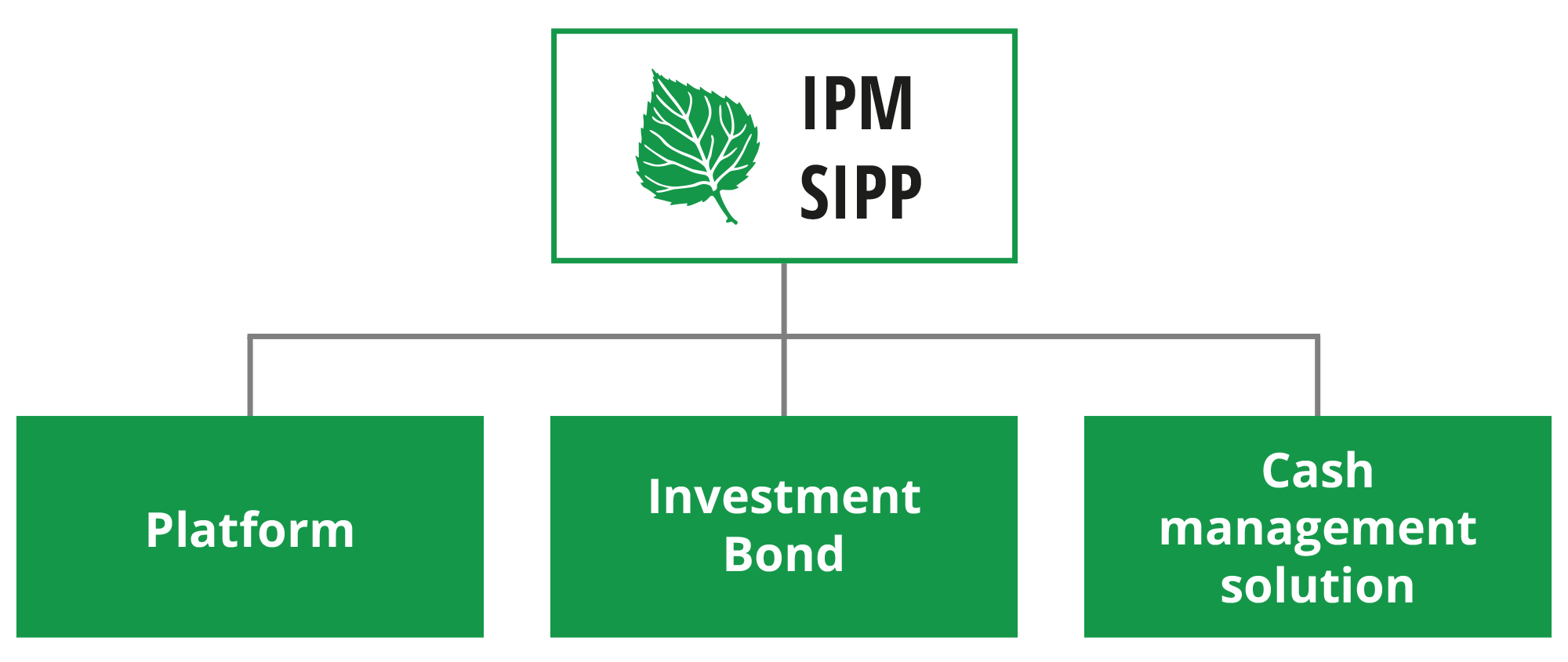

With the higher SIPP values we look after, it is not unusual to see the assets within the SIPP split amongst various investment houses, asset types, and investment structures.

For example, it would not be unusual for a larger SIPP value to be split between:

- An investment platform where the adviser would run their managed portfolio

- A portion of the SIPP in something like a Prudential bond, where the SIPP can hold the PruFund

- An element held in cash, particularly as interest rates are starting to increase.

As mentioned, we don’t operate panels of investment houses you must select from for your clients. That said, we have existing relationships with most firms that advisers probably already work with.

Platforms such as Quilter, Fusion, Fidelity, and AJ Bell YouInvest are among the companies we regularly open accounts with.

We do not levy a charge for making standard investments within a SIPP, nor do we charge different levels of annual fees to hold one or more investment.

When an investment cannot be held on a platform

Although the preference for most is to hold SIPP assets on a nominee basis for ease of valuation, sale, and purchase, at times this is not possible.

Sometimes an adviser will recommend (or a client will request) an investment that cannot be held on a platform and instead this will need to be held by IPM directly.

As considered above, a Prudential bond is a good example of this as the popular PruFund cannot be held on third-party platforms at present. Structured products and certain OEICs are also good examples of this.

Most non-standard assets will also fall into this category. While IPM does not make large numbers of these investments, we will consider these on a case-by-case basis.

A quarterly dealing hedge fund for a client who has a financial background, for example, is something we are more likely to be able to accommodate.

However, please do not ask us to look at unquoted shares, overseas, unregulated investment structures, or esoteric investments such as art, wine, or classic cars. These will all be a “no”!

Cash more appealing with interest rates rising

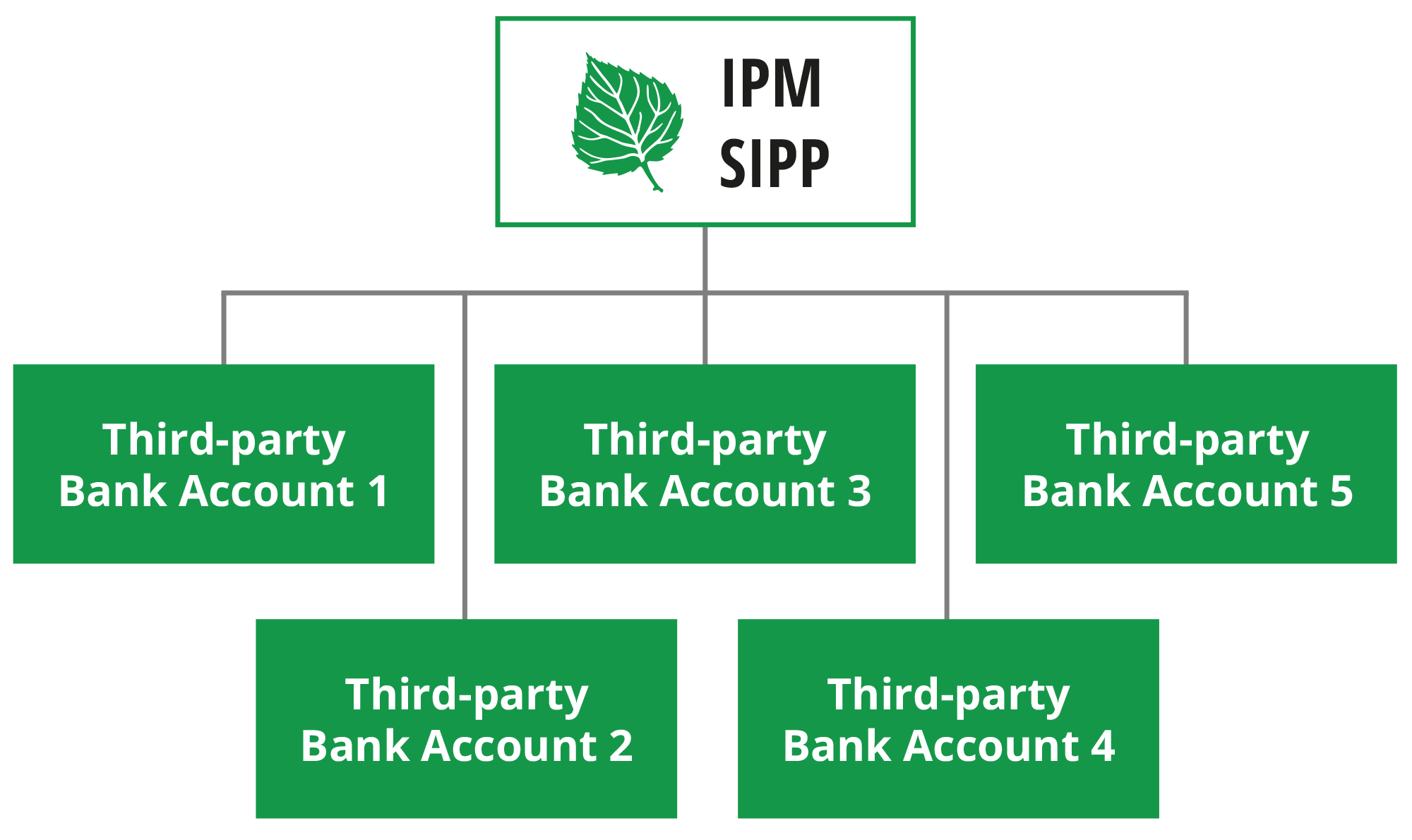

With interest rates on deposit accounts increasing, we are seeing more requests for holding cash with third-party banks, either on notice or a fixed-term basis.

Historically, it was not unusual for clients to open more than one deposit account within the SIPP as clients were keen to ensure their deposit was below the £85,000 FSCS deposit limit.

Over the last couple of years, we have seen an increase in cash management solutions, such as Insignis and Flagstone, that have come to market with SIPP-compatible offerings.

Rather than open various bank accounts as indicated above, it is now possible to open one account with these firms, transfer a lump sum to them, then make deposits with various banks through their platform. This helps with the administration for all concerned and allows online access to the deposits.

We often see cash management solutions sitting alongside traditional investment platforms within the IPM SIPP.

Single investments

Despite the appeal that we can hold multiple investment solutions within our SIPP, we still have many clients who work with IPM and hold one investment solution. Reasons for this can include where clients:

- Have a large SIPP value (usually £250,000+)

- May wish to utilise other investment houses or structures in the future

- Have specific requirements that cannot be met by a simple SIPP solution, for example holding non-GBP denominated assets or where a client lives outside the UK.

Our handy guide shows more about the benefits of the IPM SIPP and the flexibility this offers around investments.

Get in touch

If you want to have a chat about the potential of SIPPs for your clients, or any other aspects of pension planning, please contact us. Email info@ipm-pensions.co.uk or call 01438 747151.

Please note

The above article mentions various investment houses. These have been used as an example of the flexibility offered by the IPM SIPP. This is not a recommendation of any of the firms mentioned or indicates any formal relationship between them and IPM. IPM is happy to work with any investment house for your client, subject to the completion of our internal assessments.