6 valuable benefits the IPM SIPP offers your pension clients

You have previously read about the long-standing discussion of SIPP vs SSAS and the various SIPP options available in the market.

With Defaqto reporting there are more than 120 different SIPP offerings to choose from, it’s clear that, once a decision has been made to go down the SIPP route, consideration will need to be given as to which SIPP is going to be most suitable for your client’s requirements.

We believe that the SIPP market can broadly be split into three different types of offerings:

- Online SIPP

- Simple SIPP

- Bespoke SIPP.

As technology as developed and people’s lives increasingly become digital, the popularity of online SIPPs has gathered pace. With the ease of establishment and low costs, it’s easy to see why this is a growing end of the market.

However, the trade-off here tends to be that investment selection is limited to that offered by the provider your client selects, and customer service is restricted to what is offered online.

The simple SIPP is a step up in terms of investment flexibility and the service offered by online SIPPs, although your client is often still likely to see limitations in both areas.

Online SIPPs and simple SIPPs absolutely have their place in the market and provide a suitable solution for many individuals. Many will have these SIPPs for years and it will meet their requirements satisfactorily.

Many SIPP providers, in particular the more traditional providers such as IPM who started off by offering a bespoke SIPP only, will offer more than one variation of their SIPP. This is a trend we started to see in the mid-2000s when the likes of AJ Bell started developing their online SIPP offerings alongside the full-blown SIPP products.

As more of our competitors started to do the same, we had to ask ourselves a question: do we follow suit?

Focusing on our 4 key strengths

To answer this question, we looked at what our strengths were and what kind of provider we wanted to be.

We believe we have four key strengths.

People

We believe our people are one of our greatest strengths, alongside the relationships our team build with our introducers and clients. We are proud to have an experienced team at IPM, many of whom have been with us for more than 10 years. We know that this is something that is valued by people who work with us.

Flexible approach

As well as the more straightforward SIPP enquiries we receive, we enjoy helping our introducers with the more complex SIPP scenarios you may come across. For example, commercial property purchase is something that online SIPPs and simple SIPPs don’t often cater for.

Simplicity

Where a provider has multiple SIPPs, this comes with multiple approaches to investment flexibility and charging structures.

At IPM, we like to keep things simple. This is why we have the one SIPP, with a simple charging structure which has the same annual administration fee regardless of the size of the SIPP or what a client invests in.

Value

When diluting a bespoke offering, one of the things that also needs to change is the charging structure. If you are not offering a full SIPP, you cannot charge the same level of annual fee for a simple SIPP.

By reducing the annual fee, you are in a race to the bottom with others in the market.

Offering great value for the services we provide

Many businesses have faced financial challenges over the last few years and SIPP operators are no different.

Additionally, SIPP operators have also faced increased regulatory costs, higher professional indemnity cover premiums, the cost of investing in technology, and the significant increase in capital adequacy in the years building up to the pandemic.

In part, these factors have caused problems for many SIPP operators with a number closing or being sold in recent years. You recently read about what clients should do in this situation.

When it comes to our bespoke SIPP, we believe we offer good value for our services based on our charging structure.

By keeping our offering to just the bespoke SIPP, and thus our charges at the same level, this means that we can focus steadily on growing our client base and ensuring that we provide the same high level of service to existing clients as those who are just joining us.

Importantly, it also means we remain profitable, with no outside funding assisting IPM to meet our running costs.

We appreciate that, when advisers are selecting a SIPP operator for their clients, they want one they can rely on. You want to recommend a company that is well run and is going to provide a service for many years in the future.

To find out more about IPM’s structure, capital adequacy requirements and our financials, you can request a copy of our due diligence pack that contains all the information you need.

3 key benefits of our bespoke SIPP

As you will have gathered, we decided to stick with a bespoke SIPP offering. This kind of SIPP plays well to our strengths and also ensures that we can focus on organic growth, working with advisers and clients we believe we can add value to.

We appreciate that IPM will be one of number of providers you may consider when looking at options for a client. In some instances, lower costs and reduced flexibility may be more valuable to a client than our offering.

While we still work with advisers where clients have a more straightforward approach to their SIPP, here are some of the typical areas where we can really add value to your clients.

- Appeal of fixed annual fee

With a flat annual fee of £540 + VAT there is a point where the flat fee works out favourably against a client’s fund value.

Bear in mind that we charge no additional fees for:

- Setting up the SIPP

- Transfers in

- Contributions

- Making non-property, standard investments.

There are also no additional ad hoc costs for moving money.

While the value of the SIPPs we look at vary significantly, we typically see advisers and planners introduce clients with SIPPs valued around £175,000 or more.

However, the solution will sometimes drive the choice of provider regardless of costs. We recently took on a SIPP below £50,000 as the client wanted to purchase an industrial unit in their SIPP for £30,000!

- Multiple investments

By not charging additional fees for standard investments clients can be assured that, whatever their investment selection within the SIPP, IPM will not levy additional charges for holding more than one investment solution.

We also do not have panels of investment houses your clients must select from.

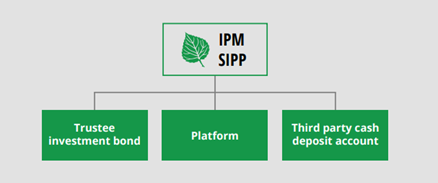

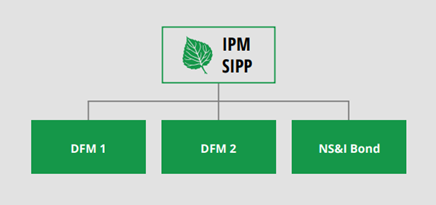

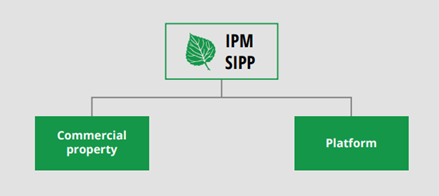

As a result, a number of our SIPPs hold a variety of assets with a number of different investment houses. Below are examples of how some of our SIPPs are structured.

- Commercial property expertise

One of IPM’s biggest areas of strength is commercial property purchase within a SIPP.

As well as having one of the most cost-effective offerings in the market for this type of work, we employ a dedicated and experienced property team. A member of this team is allocated to each purchase giving you and your client a point of contact throughout the transaction.

Feedback suggests this is something advisers and clients value, as opposed to the “call centre” approach operated by some other SIPP providers.

Find out more about our commercial property service in this handy guide.

3 more ways the IPM SIPP can add value to your clients

Here are some other areas where our bespoke SIPP can add value to you and your clients.

Overseas clients

Do you have a client who does not live in the UK or would prefer to run their SIPP in a currency other than GBP? We can help – read our guide to learn more.

Death benefit planning

While this is an area that clients may not wish to think about, the way in which their pension benefits will distributed in the event of their death is an important part of financial planning. Read about the ways our SIPP can help with this.

SSAS transfer

We often speak to advisers about SSASs that have been in place for many years and now no longer serve their original purpose.

Bespoke SIPPs can help keep that level of flexibility clients may be used to, but without the responsibility. As an example, read about how a SSAS to SIPP transfer of commercial property can work.

Get in touch

The evolution of the SIPP market over the last 20 years has been great to see.

While there is always room for new, innovative products we also believe that traditional SIPPs such as the one offered by IPM, coupled with increases in our own technological advances (have you seen that we can now accept electronic signatures on many of our forms?) will always have their place.

We’re also committed to being here to support our clients and advisers. So, if you have any SIPP-related queries, or if you have any clients for whom SIPP or SSAS advice would be beneficial, please get in touch. Email info@ipm-pensions.co.uk or call 01438 747 151.