The 10 most frequently asked questions about IPM and our SIPP

As a bespoke provider, IPM is used to being asked a wide variety of questions in relation to our SIPP. Some are straightforward. Some less so.

Last month, you read about the 10 most common questions we are asked when considering a transfer in-specie of property.

As this was well received, we thought we’d go for another top 10 this month. So here is a top 10 of some of the most frequent questions you ask us.

Some of these are general SIPP-related questions. Some of these are specific to the IPM offering. Either way, we hope you find them useful.

Is there a question you would have asked that isn’t included below? Click here to ask us! Not only will we answer that question for you, you’ll also be providing us with content ideas for when we next do a “Top 10” article…!

1. Who are the Investment Advisor and Investment Administrator? What are the roles of Investment Advisor and Investment Administrator?

If this isn’t the top question we are asked, it is certainly in our top five!

The roles of Investment Advisor and Administrator are unique to the IPM SIPP and are designed to ensure that the SIPP runs smoothly between all parties involved.

The Investment Administrator puts into effect the investment decisions and maintains the investments of the SIPP. This agreement is primarily between IPM and the Investment Administrator because the assets of the SIPP are, of course, legally owned by IPM as the SIPP operator.

However, we request that the client also sign the agreement, so all parties are aware of the nature of the terms under which the Investment Administrator operates. This role is compulsory for IPM SIPPs where investments other than commercial property are made.

The Investment Advisor is the third party with the authority to provide IPM with instructions for investing money within the SIPP. The role is optional – however, where no one is appointed, the only person able to give IPM instructions is the client.

In most instances, the introducing financial adviser is appointed to both of these roles. However, other parties appointed could include a discretionary fund manager, for example.

2. What are IPM’s fees?

Although the structure of our fees has largely remained the same for more than 20 years, we think we are asked this question because of the unexpected simplicity of our charges in comparison to other SIPP bespoke providers.

Click here to find more information on our fees. However, in summary:

- A flat annual administration fee of £540 + VAT, regardless of fund value

- No establishment fee, no transfer-in fee*, no fees for contributions, making investments** or moving money to or from trustee bank account

- Flat annual drawdown fee of £150 + VAT. No additional fees for paying income to UK bank accounts

Overall, we offer one of the most competitive charging structures in the market for holding commercial property in a SIPP, largely down to IPM not charging an annual property fee on top of our annual administration fee.

* Additional charges can apply in some cases for in-specie transfers (commercial property)

** Additional charges can apply for property and non-standard investments

3. What rate of interest is payable on the trustee bank account?

This can vary. However, we keep our website updated with the latest rate that is payable.

4. What options are available for cash investments?

This is a popular question at the moment given the level of interest rates.

Clients have various options to obtain higher interest rates within the IPM SIPP. Note that all these options do not incur additional charges from IPM. They are covered by the annual administration fee that clients already pay.

- Open deposit accounts directly with a bank – some banks still offer deposit accounts directly although their number has reduced significantly over the last few years. This site is updated regularly with a list of the banks that still offer accounts directly to SIPPs. Please note that we are unable to open accounts with Punjab National Bank.

- Set up a cash management platform account – the last few years have seen the development of cash management solutions. These are platforms that allow clients to access many savings providers all in one place. These work well for SIPPs like ours as, once IPM opens the platform account on the client’s behalf, clients are then able to log on directly to monitor their positions, give notice on accounts or place monies in new accounts. Read about how cash management solutions are used within our SIPP in this useful article.

- National Savings & Investments – NS&I are a popular choice for clients due to the higher protection levels available compared to the FSCS and perceived greater security. The bonds available for SIPPs through NS&I are the Guaranteed Growth Bond, Guaranteed Income Bond and Variable Income Bond.

5. Do you require original forms? Why do you need original paperwork?

IPM has two options when it comes to completing our paperwork:

- For existing clients – We can issue all IPM’s paperwork through DocuSign. This allows advisers and clients to complete our forms electronically, without the need of originals. Note that, in some instances, supporting documents may need to be provided to us (such as a certified copy of a bank statement when paying benefits to a new bank account). Alternatively, PDF copies of our forms can be downloaded with completed copies put in the post to us.

- For new clients – at present we are still only able to accept hard copies of the paperwork required to establish a new SIPP. We are moving to make this process electronic.

Our long-term aim is to move towards electronic signatures for our paperwork wherever possible. However, we appreciate that for all clients this is not desirable. So, will continue to accept original, hard copies of our paperwork.

If you would like to complete an IPM form electronically, let us know and we will make the necessary arrangements using DocuSign.

6. Do you offer online access? What does your online access include?

All clients have online access. Over recent years, we have generated login details for clients when we establish their SIPPs. Earlier this year we undertook an exercise where we generated a login for any client without online access.

Each client can see:

- 18 months’ worth of transactional history in their trustee bank account

- Full contribution and transfer history

- Details of the income that has been selected if they are in drawdown

- Copies of historical annual valuations issued by IPM.

For FCA-regulated advisers, we have an automated registration process for online access. Advisers can register for access here and login details will be issued automatically provided that the information entered matches the records IPM hold.

Once logged in, advisers are able to see the information detailed above for all clients where we have them noted down as the appointed adviser.

For support staff that work alongside an adviser, the adviser is able to generate a sub-login for their colleagues using their online access. This allows the adviser to control who can view the information we hold about their clients.

We also have introduced a secure messaging facility through online access. Over the coming months, we will start to issue correspondence that historically has been posted using this method.

This will start with items such as payslips, annual valuations, and IPM fee requests before progressing to other areas. The client or adviser will receive an email to the addresses we have registered on our system to tell them that a secure message is in their IPM inbox. They will then need to log in to read this.

The development of our online access is part of our long-term commitment to reducing post and paper where possible. We want to deliver correspondence and information in a more convenient and secure way for our advisers and clients.

7. How secure are client assets? What happens to the SIPPs should anything happen to IPM?

We have noticed an increase in the level of due diligence that advisers undertake on IPM, both when we first start working with them and on an ongoing basis. Click here to request copies of our due diligence pack.

The way our company and the Scheme are structured ensures that client assets are protected and kept separate from IPM at all times.

I.P.M. SIPP Administration Limited (IPM) is the FCA-regulated company appointed as Operator to the IPM Personal Pension Scheme (IPM SIPP). It collects the fees, employs our team, and pays all our bills.

We also have an Asset Trustee company, IPM Personal Pension Trustees Limited (IPM PPT). This is a non-trading company, set up solely for the purpose of being the Asset Trustee to the IPM SIPP.

Where possible, all client assets of the IPM SIPP are held on the third-party nominee of the adviser or client’s chosen investment house. Where this is not possible (commercial property, for example) assets are registered and held in the name of IPM PPT.

In the event of anything happening to IPM, the assets of IPM and the IPM SIPP are kept completely separate. A new SIPP provider would be appointed to take over the assets of the IPM SIPP and continue providing a service to clients.

8. Which investment houses can clients work with in an IPM SIPP?

We don’t operate a panel of investment houses that clients must select from within an IPM SIPP. In general, subject to our own internal assessments being completed, IPM can work with any FCA-regulated DFM, platform, stockbroker, or cash management solutions as well as banks and NS&I.

We have relationships with all the major investment houses you would expect. However, please feel free to contact us should there be a firm you wish to check we have existing accounts with. If we don’t, we are happy to take a look at them for you.

9. How do two or more people buy a property together?

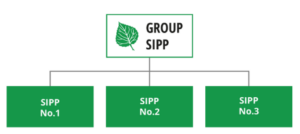

Where more than one SIPP has an interest in a property, IPM will establish an individual SIPP for each client concerned and consolidate monies in the usual way.

If these clients are then to combine their monies for a property purchase, we create a group arrangement that sits above these individual SIPPs. We move money from the individual SIPPs to the group SIPP to facilitate the purchase. In turn, each individual SIPP then owns a percentage of the group SIPP proportionate to the amount it put into the group SIPP.

By structuring the SIPP and purchase in this way, each beneficiary still has an interest in the property through the group SIPP arrangement.

However, the remainder of the SIPP can be tailored to the individual’s requirements without necessarily involving the other group members. This could be making additional contributions, drawing benefits, or making other investments that do not involve the other group members.

10. And finally, IPM stands for Independent Pensions Management… right!?

Contrary to popular belief… it does not!

When IPM was first established, the “I” and “P” were the initials of the village where our director lived at the time. The “M” was added to reference “management”.

It just happens to turn out to be a happy coincidence that this could also reference independent pensions management.

Get in touch

If you want to have a chat about the potential of SIPPs for your clients, or any other aspects of pension planning, please contact us. Email info@ipm-pensions.co.uk or call 01438 747151.