Online illustrations and forms now available – find out more

Many advisers who work with IPM will know that we have been developing our online offering for some time now. We are continuously working to increase the information available for both advisers and clients online.

In March 2023 we overhauled our adviser online access, giving our advisers greater control over how they control the information they can share with their colleagues using our new sub-login function.

For advisers new to IPM, our registration process is now automated once they have introduced a client to us, meaning they do not need to wait for this request to be processed manually as previously was the case.

At the same time, we took the first step towards introducing secure messaging through the IPM login for both clients and advisers. This has increased the security around the way we share information with you about your clients.

We are now pleased to announce two further enhancements to the adviser online access:

- Online illustrations

- Ability to complete IPM documents online.

These will go live on Monday 26 February 2024 – read on to find out how this functionality will benefit you and your clients.

Produce client illustrations online

Advisers can now generate illustrations online.

We appreciate that this is something you have been requesting for some time. Now that we have made the other amendments to our online access facility, we are able to host the software required to produce illustrations.

IPM licences its illustration software from CTC Pension Technology who specialise in bringing innovative technology solutions to the pension industry.

As a bespoke provider, our illustrations are unable to link to specific investments. Instead, you can choose for the money in the SIPPs to be held in a variety of asset classes such as cash, fund platform, trustee investment bond, or property, all of which have generic yields.

You can add in any annual management charge for the investments that you wish, as well as adding initial and ongoing adviser charging to the overall amount in the SIPP.

There are several different types of illustrations that you can produce online:

- Retirement Accumulation – this is the most common type of illustration that you ask us to produce. You can use this to show transfers or contributions for new IPM SIPPs, to show new monies coming into existing SIPPs, or to simply project the potential future value of an existing SIPP using a current valuation.

- Income Withdrawal – these illustrations should be used when benefits are to be drawn from either a new or existing IPM SIPP. This offers the same flexibility as the Retirement Accumulation illustration in terms of monies in the SIPP, but with added functionality concerning how these monies are drawn from the SIPP by PCLS, income, or a combination of both.

- Review – a review illustration is used for a SIPP that is fully or partially crystallised. It will show the impact on a SIPP value where the existing level of benefits being drawn is maintained over a period.

- SMPI – a Statutory Money Purchase Illustration (SMPI) is a type of illustration that IPM must produce on an annual basis to show the potential value of benefits to an individual in their IPM SIPP. We expect there to be only a few occasions where an adviser wishes to raise a SMPI.

You and your clients can now complete and sign forms online

You may be aware that, in the last year, most IPM forms have been available to complete electronically.

We appreciate that one of our advisers’ biggest frustrations with IPM is “all the paperwork” we ask for when a client wishes to take benefits, purchase a property or make a contribution to their SIPP.

We hear you – loud and clear!

That’s why we have partnered up with DocuSign, one of the world’s leading providers of e-signature technology, to remove the requirement to send in original copies of IPM paperwork by post.

To date, when an adviser has requested a form from IPM, we offer the option of issuing this electronically. If agreed, we will set up an envelope on DocuSign that is sent to the adviser in the first instance to complete, then on to your client for approval and signature.

A copy of the completed form is then sent to all parties including IPM. Assuming the form has been completed correctly, this will usually complete our requirements.

We are now going one step further.

When you log on to the IPM system, you will now be able to generate the DocuSign forms yourself and send these to your client, without the need to request these from IPM.

Then, when you click the required form, you will be taken to the IPM branded part of the DocuSign site and asked to enter your name and email address along with the same for your client. The system will generate the envelope that will then land in your inbox.

Once you have completed everything you need to, the forms will be sent to your client. Once they have approved and signed the form, a completed copy of the document is sent to all parties including IPM.

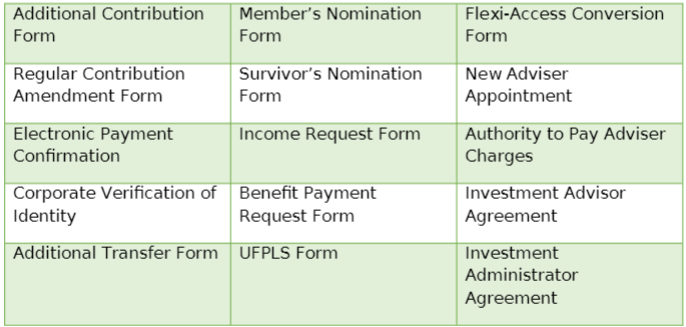

Initially we will be launching the following documents as part of our online forms:

Finally, we are also working hard to offer the option to set up new SIPPs electronically, without the need for you/clients to send paper copies to our office. We are making good progress here and hope to be able to make an announcement on this in the coming months.

How to obtain an IPM login if you don’t have one

For an adviser to register for online access you must have an active client with IPM where you are appointed as the financial adviser.

If you work in a support role, the adviser appointed to an IPM client can create a sub-login for you to have access to client information and the above new features.

If you are an adviser with existing clients and you don’t have a login with IPM, head here to register. Alternatively, if you have previously registered with IPM, you can login here and check out the new features from 26 February.

The above investments into our service proposition are a further example of our commitment to evolving the IPM SIPP offering to better serve our advisers and their clients.

However, don’t worry – we are not going fully online!

We appreciate that some advisers and clients still like to complete paper forms, pick up the phone to speak with us and build relationships with our team. This personal approach is a core part of IPM’s ethos and something we will continue to offer in the years to come, with an eye on how we can make better use of technology to improve the service we offer.

If you have any questions about these new online functions, please email info@ipm-pensions.co.uk or call 01438 747151.