Lifetime Allowance freeze set to impact many SIPP pension savers

Despite much speculation, this year’s Budget didn’t contain much that might affect a client’s pension.

We’ve talked elsewhere about how a SIPP could help clients to mitigate a planned rise in Corporation Tax from 2023.

One of the key pension announcements was a freezing in the Lifetime Allowance (LTA) until 2026. Of course, freezing the LTA at the current level of £1,073,100 won’t make a substantial difference to savers in the short term, as allowance would only have increased to £1,078,900 in the 2021/22 tax year anyway.

However, the longer-term effect of the freeze will create work and planning considerations for advisers who have clients who are approaching the £1 million figure in the coming years.

Hitting the Lifetime Allowance isn’t just for the super-wealthy

IPM’s SIPP offering typically attracts high net worth individuals so this freeze will have an impact on their plans for their pensions. Clients will have to consider how best to mitigate a Lifetime Allowance charge in the future.

And, of course, freezing the LTA means that more and more savers will be caught by this tax trap considering that £1 million in pension savings is not out of the reach of many of these kinds of savers.

Professional Adviser reports that, since 2016, the CPI linking of the LTA has increased it by 7.31% but the cost of buying a lifetime income has increased by 22%. To keep pace with the true cost of securing a retirement income since 2016, the LTA would now need to be £1,293,100.

While £1.07 million might look like a large fund, Aegon have calculated that it would typically buy an income for life for someone aged 65 of around £26,100 a year increasing in line with inflation* before tax.

A basic-rate taxpayer would receive around £1,740 a month after tax – not exactly enough to provide a lifetime of luxury.

Standard Life have published similar figures. They say that, for someone seeking to keep their drawdown income withdrawals at a sustainable level to last maybe 30 years and to take into account inflation, a withdrawal of around 3% provides an annual income of around £32,200 before tax.

A concern of freezing the Lifetime Allowance – essentially the amount clients can hold tax-efficiently in pensions – would be that it risks sending the wrong message to people diligently saving for their retirement.

It also means that the Lifetime Allowance is likely to impact more individuals, especially those who have seen good investment growth in their pensions over the years.

If someone has a fund worth £800,000 now and makes no further contributions, they will breach the Lifetime Allowance of £1,073,100 in eight years’ time based on just a 4% annual growth rate.

A disincentive to save

While it is understandable the government may look to pensions for tax savings at this time, and the amount of people this will impact is proportionately low, it does create a disincentive for those people to save and take investment risk with their pension.

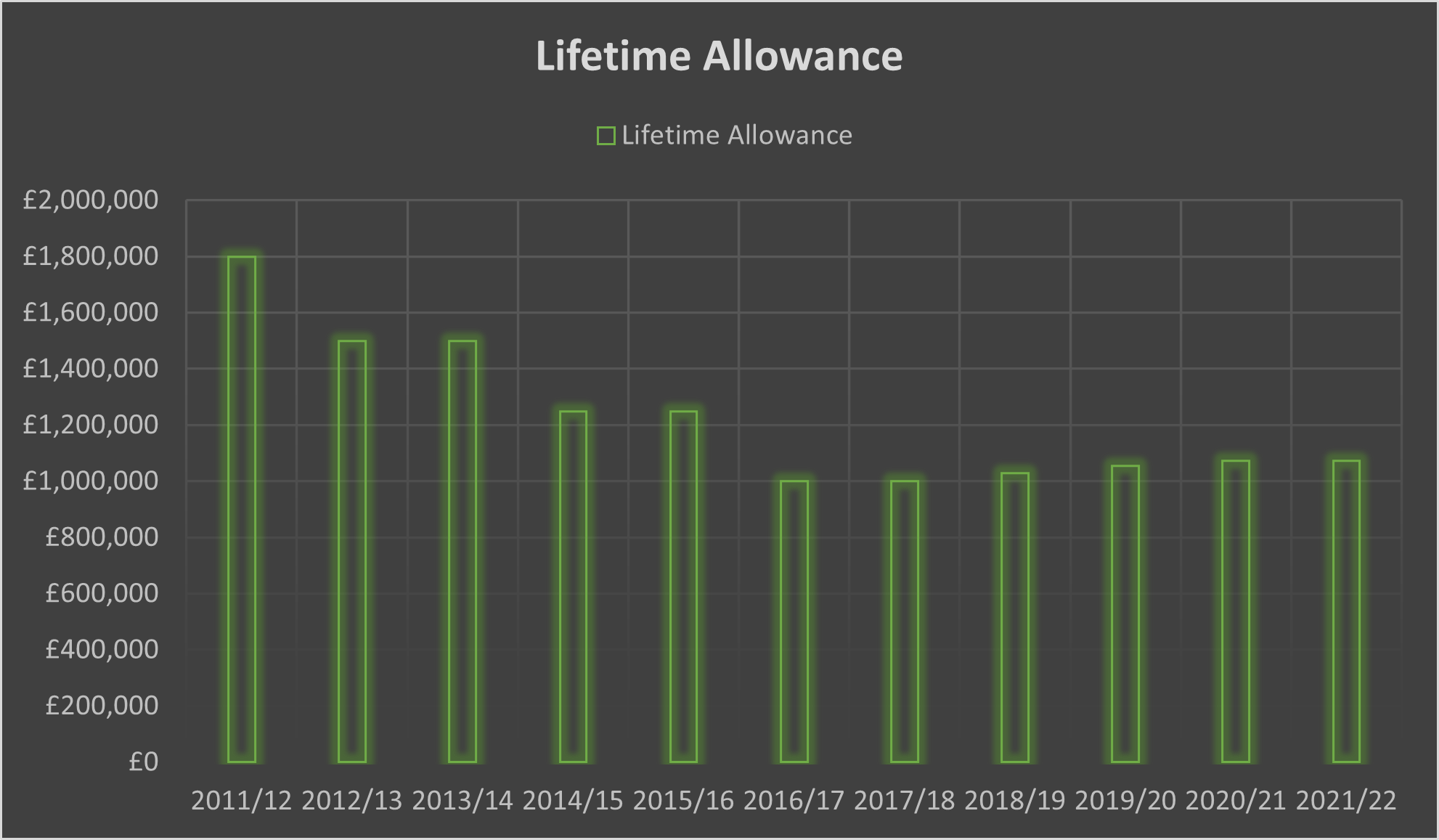

This is especially true when you consider how much the levels of the Annual Allowance and the Lifetime Allowance have reduced since 2011.

The LTA in defined benefit schemes is an annual pension amount of one twentieth of the “cash” limit, or £53,655 a year.

This freeze means that, for those wishing to accrue benefits in excess of the Lifetime Allowance, they will need to accept the additional tax charges that will apply.

Of course, this tax can be punitive, with an eye-watering 55% tax charge on savings above the allowance taken as a lump sum, or 25% if taken as an income.

In addition, it will likely create additional work for advisers as more and more clients are impacted by the LTA. The tests against the LTA can be complicated when multiple schemes are involved, especially where you have a client with defined benefit and defined contribution schemes crystallising at the same time.

Perhaps the one key thing to remember is that while this freeze may hit many of our SIPP clients, the LTA is an allowance and the charge is designed to recoup tax relief given, not to have an overall negative impact on savings.

Get in touch

If you have any SIPP-related queries, or if you have any clients for whom SIPP or SSAS advice would be beneficial, please get in touch. Email info@ipm-pensions.co.uk or call 01438 747 151.

*Retirement income at 65 is based on how much it currently costs to buy an annuity using the average of the top three annuity rates from the Money Advice Service annuity comparison tool on 2 March 2021. Income is paid monthly in advance and assumes the individual is in good health. We assume the income will increase in line with the RPI measure of inflation.