How pension contributions could help mitigate the National Insurance and Dividend Tax rises

Employer contributions to pensions have been a longstanding feature of an individual’s remuneration package, even before the introduction of auto-enrolment in 2012.

At the high net worth end of the market, we are used to seeing large contributions, especially when in 2010/11 the Annual Allowance was set at the dizzying amount of £255,000.

Today the Annual Allowance is set at a more modest level of £40,000. However, with carry forward of used allowance from previous tax years, large pension contributions are still possible for those people with the means to do so.

It is well known that personal pension contributions are eligible for tax relief. The basic rate of 20% is reclaimed by the pension provider while any higher- or additional-rate relief can be reclaimed by the individual personally.

However, where this payment is made from earned income, National Insurance is also paid – and this cannot be reclaimed.

Where a contribution is made directly by an employer on an individual’s behalf, sometimes known as “salary sacrifice”, there is no National Insurance to pay.

As a salary sacrifice payment, the employer also does not need to pay employer’s National Insurance. If an individual asks nicely and has sufficient Annual Allowance, perhaps generous employers will pass this saving on to their employee!

Example

A basic-rate taxpayer receives a £200 a month pay rise and wishes to pay this into a pension.

By paying the contribution out of salary, this would be taxed at 20% (£40) and National Insurance paid at 12% (£24) before the employee receives the net amount, £136. This is paid to the individual’s pension.

The pension provider then reclaims 20% of the £136 (£27.20), giving a total pension contribution of £163.20.

The employer would also pay £27.60 National Insurance on the increase.

If the individual asked their employer to pay the salary increase as a pension contribution, not as salary, the full £200 could be paid as a contribution.

Additionally, the employer would potentially not need to pay the £27.60 employer’s National Insurance contribution.

Government set to hike National Insurance in 2022

The reason for mentioning this is in light of the government’s announcement that National Insurance contributions for employees, employers, and the self-employed will increase by 1.25 percentage points from April 2022. The revenue raised will go towards funding social care and helping the NHS recover from the pandemic.

The increase will be rebranded as a separate “Health and Social Care Levy” from April 2023.

Even though the chancellor announced in the spring statement that the National Insurance Primary Threshold will be raised, the increase in 2022 is not insignificant.

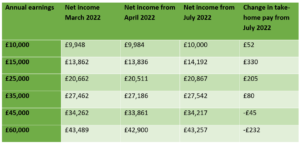

As an example, someone with an annual salary of £60,000 will pay an additional £232 in NICs, taking into account both the threshold and the rate rise. The table below shows what the two changes mean for different salaries.

Source: the Guardian

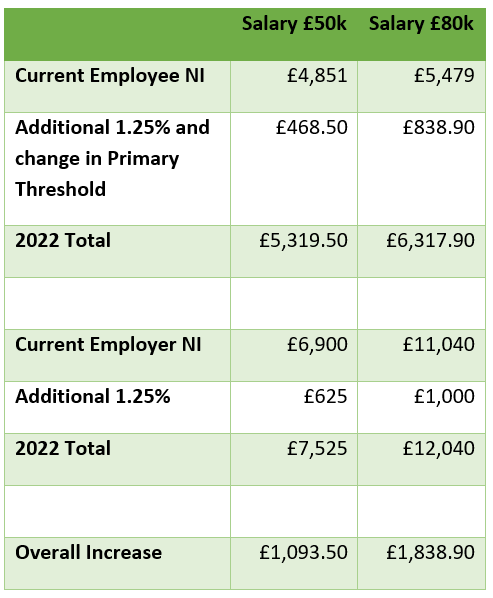

On top of that, employers will pay a National Insurance rate of 15.05% from April 2022.

For the individual earning £50,000 this would see the amount of employer’s National Insurance increase from £6,900 to £7,525. For the individual earning £80,000, the amount would increase from £11,040 to £12,040.

Where can a pension assist?

Like with any changes to tax, these increases give advisers the opportunity to discuss with their individual and corporate clients the best way of tax planning for the year ahead.

Pension contributions can form part of these discussions – more specifically employer pension contributions and salary sacrifice. Using these options will help clients to mitigate the impact of the rise in National Insurance contribution rates.

Perhaps if a particular client was planning a large employer pension contribution, 2022 could be the year to do this?

Get in touch

If you want to have a chat about the potential of SIPPs for your clients, or any other aspects of pension planning, please contact us. Email info@ipm-pensions.co.uk or call 01438 747 151.