Here’s everything clients can put in a SIPP

You may recall that, last November, we celebrated our 20th birthday. It is fair to say that the SIPP market has evolved significantly since we launched in 1999!

When we first started in 1999, most SIPPs were full SIPPs which allowed investment into a wide variety of assets, with alternative personal pension options being provided by insurance company offerings in insured funds.

Today, there is a vast array of options available to financial advisers and clients when it comes to SIPPs. Those companies offering SIPPs range from specialists such as IPM, to insurance companies, to investment houses.

The investment company SIPPs will usually be restricted to holding assets in their in-house investment solutions. Insurance company SIPPs will usually be similar, although there are exceptions for both.

Often, a provider offering SIPPs will have more than one SIPP available – the difference between each being the investments clients can make. It is not unusual to see providers offering three tiers of SIPPs:

- A single investment SIPP

- A panel of investment houses to choose from

- A full SIPP offering.

While this innovation within the market is positive, the choice can be overwhelming. In some scenarios, a client’s long-term aims for their SIPP will be clear and a single investment SIPP with a particular investment house will be sufficient.

But what if the client wanted to split their exposure to an investment house, or make an investment that cannot be held by the firm they choose to work with?

The IPM SIPP allows a wide range of investments

Most of you will be aware that IPM only has one SIPP: the IPM SIPP. This is a full, bespoke SIPP offering.

We allow a wide range of investments within our SIPP, subject to our usual assessment criteria. This means your client can select from any discretionary fund manager, platform, bond provider, stockbroker, or third-party bank account. We do not operate panels of investment houses you must select from.

For most of our SIPPs, clients will pay our annual administration fee of £540 + VAT, regardless of the number of investments held within the SIPP. Read more about the investment flexibility we offer on our website.

As the market develops, we regularly review our proposition. Over the years there has sometimes been a temptation to follow some of our competitors and offer a suite of different SIPP solutions. However, we decided that one of our key USPs is our simplicity; one full SIPP with a flat fee.

While we appreciate this approach does not suit every client, we feel this does well position us with the higher end of the market and those clients who require a bit more support. Here, a flat fee is generally preferred, and we can also deal with the less straightforward scenarios you may work on – for example, commercial property purchase.

When we speak to advisers, they are sometimes still surprised by the amount of flexibility the IPM SIPP can offer and the range of investment houses we can work with. We therefore thought it would be helpful to share some of the SIPP scenarios we work on.

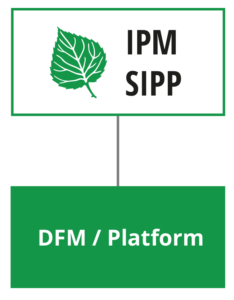

Single investment

We still have many clients that use the IPM SIPP to access one investment house.

Usually, these will be:

- Clients with a large SIPP value (more than £250,000),

- Where the client may wish to utilise other investments within the SIPP in the future

- Where the client has specific requirements that cannot be met by lower cost SIPP offerings (i.e. holding investment in non-GBP currency or where the client is not based in the UK).

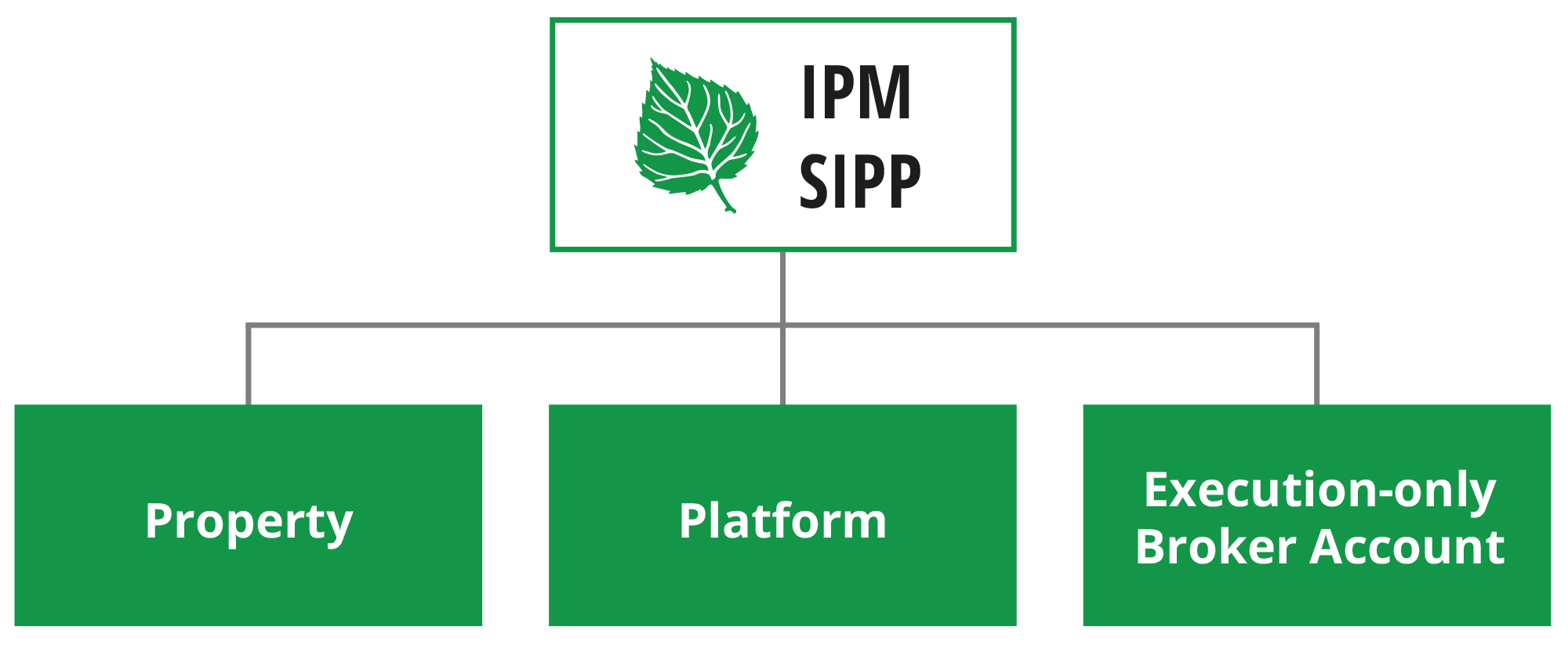

Property plus other(s)

IPM are specialists in commercial property, with more than 1,000 properties owned on behalf of our clients. Read more about our commercial property services.

While some purchases will exhaust the monies within the SIPP or will require borrowing that needs to be repaid, often there will be a balance of cash left in the SIPP which can be invested. There’s also the rental income to consider.

The IPM SIPP allows clients to hold any investment solution alongside a commercial property at no additional charge.

We often see advisers putting their preferred platform into the SIPP after a purchase has been completed to manage any residual balance in the trustee bank account. IPM can also direct any future incoming rental income into the chosen investment vehicle at no additional charge.

In addition, we don’t restrict clients to one investment solution. We have clients who, alongside property and an investment platform, also hold third-party bank accounts, and execution-only broker accounts on an investment bond such as PruFunds, in their SIPPs.

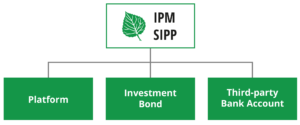

Larger SIPP values, more investment houses

With the higher SIPP values we look after, we often see the monies split between different investment houses and/or asset classes.

Although we do not work on great volumes of Defined Benefit transfers, this is particularly true for these types of transfers where the amounts received are at the larger end of what we would expect to see.

For example, it would not be unusual to see a transfer of this type split between:

- An investment platform where the adviser would run a managed portfolio

- A portion in a Prudential Investment Bond so that the client was able to access PruFunds

- A third-party bank account for some of the transfer value.

The amounts in each vary depending on a client’s attitude to risk. Where the amount exceeds the £85,000 FSCS limit, we’ll often open more than one account.

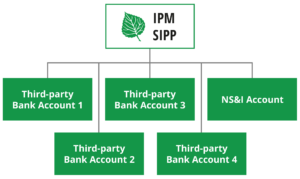

Cautious clients seek cash

As suggested above, it is not unusual for IPM to open several third-party bank accounts for clients who want to take a cautious approach to their investing, so as to keep each account below the £85,000 FSCS limit.

As well as bank accounts, we are also able to hold National Savings & Investments within our SIPP, and this allows access to savings up to £1 million.

For those clients with larger sums to hold in cash, the advent of cash management platforms is welcome. In the past we have had clients who have more than £500,000 they wish to keep in cash spread across various banks to stay within the FSCS limit!

When an investment cannot be held on a platform…

Although the preference for most is to hold assets on a nominee basis, for ease of valuation, sale, and purchase, this is not always possible. Sometimes an adviser will recommend an investment that cannot be accommodated on the platform of choice and instead will need to be held by IPM directly.

PruFunds is a good example, as the only way to access this via a third-party SIPP provider at present is via a Prudential Investment Bond. Additionally, investments such as structured products, certain OEICs, hedge funds, or non-standard investments in the eyes of the FCA are examples where IPM will make investments on behalf of clients and have these held in our Asset Trustee name.

Get in touch

The number of different examples we could have shown here is extensive. However, what we wanted to do was highlight what is possible using an IPM SIPP and demonstrate how cost-effective our offering can be in these scenarios.

If you want to have a chat about the potential of SIPPs for your clients, or any other aspects of pension planning, please contact us. Email info@ipm-pensions.co.uk or call 01438 747 151.