Consumer Duty and IPM: Everything you need to know (and some useful FAQs)

We’re sure that we do not need to remind anyone who works for an FCA-regulated firm that 31 July 2023 is the implementation date for Consumer Duty. It’s a key part of the FCA’s ongoing efforts to further protect consumers from financial harm.

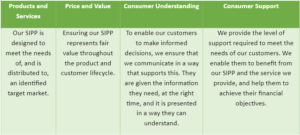

At its core, Consumer Duty has the overarching principle that a firm must act to deliver good outcomes for retail customers. It sets out expected behaviours and a range of consumer outcomes financial firms must meet and be able to demonstrate to ensure they are acting in the best interests of their customers.

You may be familiar with the two terms used to describe regulated firms: “distributor” and “manufacturer”.

As a manufacturer, IPM has been looking at our business with the Duty in mind to see where this will have an impact and what changes we will need to make. We have also been considering what this will mean for our relationships with advisers (“distributors”) and how best we can assist adviser firms to satisfy their Consumer Duty requirements.

What does Consumer Duty mean for the IPM SIPP?

Helping our members to thrive in retirement has always been at the heart of our business, so the fundamentals of Consumer Duty are not new to us.

We provide dedicated customer service, clear and simple pricing, easy-to-read and accessible literature, and experienced and highly technical administration and property teams.

Focusing our efforts on ensuring our SIPP aligns with the Consumer Duty outcomes

In the lead-up to the implementation deadline on 31 July 2023, we have focused our efforts on ensuring that our product meets the rules and guidance around the four outcomes.

We completed the manufacturer reviews necessary to meet the outcome rules for our SIPP. We have shared these in our Target Market Statement and Fair Value Assessment documents to help financial advisers (distributors) meet their obligations and identify if and where any changes need to be made.

We thought it would be helpful to put together a Consumer Duty FAQs for our advisers, which we hope will cover most of the questions you may need to ask of IPM to satisfy Consumer Duty.

How do I find your Target Market Statement and Fair Value Assessment?

These will be available on our website by following the links:

How closely do I need to follow your Target Market Statement?

The statement tells you who we’ve defined as the target market for our product and who we think the product is suitable for.

You should ensure that the way in which you distribute the product aligns with customers within the target market. You also need to regularly check that the way in which you’re distributing the product aligns with customers in the target market.

If you wish to recommend our SIPP to a customer who you have identified as being in our negative target market, please contact us to discuss the details. Our SIPP may still offer fair value to your client, depending on the circumstances.

Do I need to check IPM’s Fair Value Assessment?

Distributors only need to ensure that the product continues to offer fair value when their charges for distributing products or services are added.

We have tried to include information in our value assessment to reflect this. All firms in the distribution chain are responsible for the value of the prices they control.

How often will IPM review their Target Market Statement and Fair Value Assessment?

We will conduct reviews on an annual basis.

Our assessment of fair value, and whether new SIPPs are within our target market, has been incorporated into our management information.

The FCA say that IPM should review their agreements with distributors. When will you contact us about this and what is required from us?

We have made changes to our Terms of Business documents as part of our work in the lead up to the Consumer Duty. We will roll these out to distributors in August 2023.

If you have found your product doesn’t offer fair value to customers, what will you be doing?

We are satisfied that the IPM SIPP continues to offer fair value to consumers within our identified target market.

How will Consumer Duty affect the communications you issue to customers?

Consumer Duty requires that customers are provided with the information they need, at the right time, and that it is presented in a way they can understand. This is to support and enable informed decisions about financial products and services.

We have recently enhanced our online access to our members to enable us to communicate easily and provide effective support and information.

The enhancement also allows us to request regular feedback from our members to ensure that their needs are being met.

I remember seeing an email about IPM’s online access. Did I need to do anything and why was this sent?

Part of our online access enhancement is the ability to send secure messages to clients and advisers on a more efficient basis. When IPM sends a message through secure messaging, we will send an email to the registered email address of that login to make you aware there is a message waiting for you.

To implement this, we require advisers to re-apply for access. If you haven’t already, head here to do so.

Note that the automated registration process is for FCA-regulated advisers only. If you work in a support role, you are still able to access client information. Once an adviser has registered, they can create a sub-login for you which gives you access to the information IPM holds in relation to that adviser’s SIPP clients.

How are you embedding Consumer Duty principles into your business?

The Consumer Duty Project within IPM was implemented to review our communications, processes, risks, and customer journeys. Our aim is to ensure we deliver all outcomes in line with the Duty.

We also plan to provide Consumer Duty training to all our administration team. The aim of this is to ensure that any changes to our processes are fully embedded as part of the Consumer Duty culture.

How has Consumer Duty changed the support that IPM provides to customers in vulnerable circumstances?

Our SIPP is used by a broad range of customers, and we recognise that, at any time, our customers’ personal circumstances can cause them to exhibit characteristics of vulnerability. We are asking both our customers and distributors to let us know when there is a need for additional or tailored support.

As part of our Consumer Duty reviews, we have re-examined the support we provide to customers in vulnerable circumstances. We have incorporated considerations around vulnerability into our communications, service, and product review. We have also reached out to external organisations, such as Scope and Age UK, to ask how our service can be tailored to further support those with additional needs.

Please contact us if you have any questions

The FCA expects the principles of Consumer Duty to be fully embedded into regulated firms’ processes and culture.

We were pleased to see that a lot of what the Duty asked of manufacturers were things that IPM already practises. However, there was still a lot we could change and improve.

Consumer Duty will be something we continue to work on, with our end goal being better client outcomes. We appreciate that advisers will be doing the same and if there is anything you feel that IPM can do to assist you further with this, please let us know.

Email info@ipm-pensions.co.uk or call 01438 747151.