Case study: How commercial property purchase in a SIPP can benefit business owners and their companies

This article is intended for financial services professionals only. None of the information contained in this article should be received as advice. Pensions are a complicated area of financial planning and IPM suggests that financial advice from a suitably regulated financial adviser is sought before an individual takes any action in respect of their pension savings.

With over 1,200 properties owned on behalf of our clients (as of August 2025), we see a wide variety of commercial property transactions take place in SIPPs.

This can vary in terms of the types of property we own, whether we are accepting a transfer in-specie from another SIPP or SSAS provider, all the way to how the client will fund the transaction.

We also have many discussions with advisers about business owner clients looking to use their pensions to assist with their business premises. Scenarios we regularly look at include:

- Where the business is renting a property and the landlord has agreed to a sale

- Clients who have identified a property on the open market that they wish to purchase

- Selling a property already owned in their business to their pension scheme.

We will focus on this last scenario here. We thought it would be useful to share a real-life case study we have recently worked on, showing the scenario the adviser was presented with, the solution applied, and then, finally, the benefits of the transaction, both for the clients’ pension funds and their business.

The scenario: 3 business owners look to contribute to their pensions from business profits

Isabelle had three clients who were owners and directors of a successful recruitment firm: Oscar, Ivy, and Max. Their business owned the offices from which they operated. There was no mortgage.

Each of Isabelle’s clients had built modest pension benefits over time. However, after several successful years, there was money within the company which Isabelle had earmarked to pay into pensions for each of the directors as employer pension contributions.

Each client’s current position was as follows:

- Oscar: £92,000 SIPP

- Ivy: £68,000 SIPP, £34,000 personal pension plan

- Max: £105,000 SIPP

The offices that the business traded out of were valued at £450,000. Based on the red book valuation carried out by a surveyor, the market rental value was £36,000 a year.

When Isabelle met with the clients to discuss the pension contributions from the company, the directors suggested that they were reluctant to withdraw funds from the business as an acquisition opportunity had presented itself, which they wanted to explore further.

Isabelle acknowledged her clients’ concerns but suggested that, by transferring ownership of the property to their SIPPs, there may be a way they could have both the pension contributions and the money in the business for this potential acquisition in the future.

The solution: Using a group SIPP property purchase to achieve personal and business goals

Isabelle explained to the clients that they could pay the planned contributions into SIPPs and then sell the property owned by the business to those SIPPs. In doing so, they could benefit from the tax advantages of making employer pension contributions, while still having the liquidity within the business for any future acquisitions.

Isabelle also explained that, as the property would then be owned by the SIPPs, the company would need to pay rent to the pensions for use of the business premises. This would also come with tax advantages.

Isabelle set up three separate SIPPs with IPM for each of Oscar, Ivy, and Max. Into these, she consolidated the clients’ various pension pots and recommended that the company pay pension contributions. Each client had unused Annual Allowance from previous years, allowing them to make contributions of £80,000 each.

This increased the business owners’ pension wealth:

- Oscar: £172,000 SIPP

- Ivy: £182,000 SIPP

- Max: £185,000 SIPP

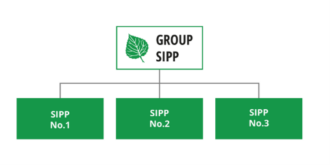

Isabelle then recommended that the clients create a group SIPP arrangement, and each client put sufficient funds from their individual SIPPs into the group SIPP to purchase the offices from the business.

Once all costs for the acquisition of the property plus Stamp Duty were taken into consideration, Isabelle recommended that each client move £156,000 into the group SIPP, creating a total pot of £468,000 to make the purchase.

Once the SIPPs were established with the required minimum amount, IPM was then able to instruct solicitors to act for the SIPP on the purchase.

It’s important to note that the sale of a property from a business to a SIPP is a change of legal owner. Therefore, both the business and the SIPP will require solicitors to act in their interests during the transaction. The business will need to pay any costs incurred by its solicitor throughout the process, too.

This will also demand a red book valuation as per HMRC requirements during the transaction. IPM is happy for any RICS surveyor to be appointed to carry this out.

This valuation will include the market value rent of the property, which, on this occasion, was £36,000 a year. The business would need to pay this amount to the group SIPP in exchange for use of the property. During the conveyancing process, IPM’s solicitor will prepare a lease for all parties to sign.

The transaction then proceeded on the same basis as any other, with solicitors corresponding until such time as all parties were happy to exchange and complete.

On completion, the monies were then paid from the group SIPP bank account to the company bank account via the solicitors, and the group SIPP became the legal owner of the property.

The outcome: Keeping control of their company while contributing tax-efficiently to their pensions

As Oscar, Ivy, and Max all contributed an equal amount to the group SIPP to facilitate the purchase, their individual SIPPs now each own an equal third share of the group SIPP that holds the property. The rent is paid in monthly instalments of £3,000 by the business to the group SIPP. This is then split three ways, so each of Oscar, Ivy, and Max’s individual SIPPs receives £1,000 a month into their trustee bank account.

Isabelle has set up individual platform accounts in each client’s SIPP. This then allows the rental income, along with any balance in each SIPP after the purchase, to be invested in line with each client’s individual investment strategy.

Despite paying out a total of £240,000 in pension contributions for Oscar, Ivy, and Max, the business has now received £450,000 (less costs) from the sale. That leaves plenty of liquidity in the business in case of any future acquisitions.

Crucially, the clients have raised this liquidity without relinquishing control of the property.

The property is now legally owned by IPM in our role as trustee of the SIPP, but the clients still have control over what happens with the property in the future, provided that rent continues to be paid as agreed.

While group property purchases can be beneficial at the time they are carried out, consideration should be given to circumstances that could arise in the future as a result of holding property jointly in a SIPP. We have previously written about these considerations, explaining the four “Ds” of group property purchase.

The financial advantages

The benefits of pensions are well-known – even if an Inheritance Tax-shaped issue is coming over the horizon. However, at times, it is easy to forget how these apply in reality when undertaking a property purchase via a SIPP.

When looking at Oscar, Ivy, and Max’s scenario, by following Isabelle’s advice:

- The company has saved almost £60,000 in Corporation Tax, as company pension contributions can be counted as a business expense.

- The clients now have a £450,000 asset in the form of the property in the SIPP, meaning there will be no Capital Gains Tax (CGT) to pay on disposal.

- The company must pay market value rent for use of the property. Not only can this save towards £7,000 in Corporation Tax a year, but this money is being paid into the business owners’ individual pension arrangements, further increasing their retirement savings.

- Rental income does not count towards the Annual Allowance for pension contributions. This means that, as well as the rent each SIPP receives from the company (£12,000 per year per SIPP), there is still an Annual Allowance of £60,000 (plus any carry forward) that the company could pay to the clients.

- The rental income received is not subject to any tax. This can be re-invested within the SIPP based on Isabelle’s advice, with no other taxes due.

- The money from the sale of the property goes straight back into the business, keeping liquidity high and the clients in complete control of the property, as this is owned by their SIPPs.

Get in touch

If you want to have a chat about the potential of SIPPs for your clients, or any other aspects of pension planning, please contact us. Email info@ipm-pensions.co.uk or call 01438 747151.